Pound slightly rises debunking Johnson\'s threat of a futile Brexit

It would seem that the statement that Britain is preparing to leave the EU without a deal and will focus on relations with the European Union on the Australian model, should have dropped the GBP/USD quotes. The negative impact of the pandemic on the economy of the United Kingdom in this scenario will increase, which increases the likelihood of a double recession and negatively affects the national currency. The pound, on the contrary, after a slight fall, is trying to return above the psychologically important level of 1.3 only because the market does not believe a single word of Boris Johnson.

Investors believe that by saying that Michel Barnier should not come to London without a new plan, the British Prime Minister decided to encore the story of a year ago. Then he managed to get the transition period extended on a falling flag through the use of threat tactics, which eventually bore fruit, and the Cabinet received a laurel wreath for its patience. Will Brussels want to make concessions? He is well aware that Boris Johnson is bluffing, but in such a situation, one awkward move – and a successful Brexit can be put an end to.

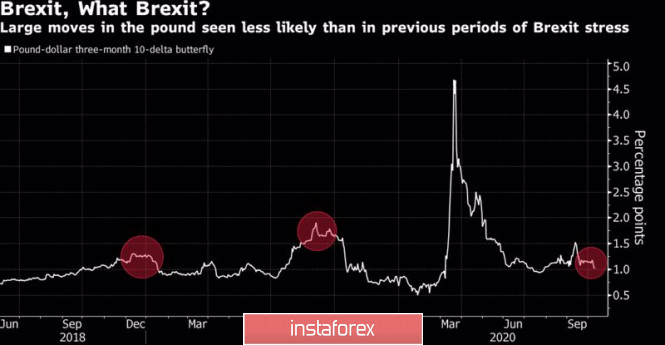

The sterling's reaction hardly surprised anyone. The GBP / USD sellers were waiting for the message about the termination of negotiations, but they did not wait for it. Anyway, the couple has been living for four years in an environment where the headlines about Brexit swing it from side to side. One could get used to it and start filtering the incoming information. For example, perceive the loud statements of Boris Johnson as a theatrical performance. Indeed, the options market is signaling that sharp movements in sterling are unlikely in the next three months. Investors believe that at least some deal will be concluded.

Dynamics of the probability of sharp movements in sterling:

Brexit distracts attention from other important events: the pandemic and the US presidential election. In the States, everyone practically believed that Joe Biden would celebrate the victory, but they doubt that the Republicans will hand over the Senate to the Democrats. If the political uncertainty continues after the November 3 elections, the US dollar will continue to be in demand.

The rise in the number of COVID-19 cases in the UK is forcing the introduction of repeated restrictions, which heightens the risks of a double recession. At the same time, statistics on inflation, retail sales, and business activity should show the state of the economy of the UK and whether the Bank of England should introduce negative interest rates. Recently, Andrew Bailey has tried to muffle the conversation, but the fact that the central bank has conducted a survey on whether companies are ready for borrowing costs below zero suggests that such a possibility cannot be ruled out.

Technically, the GBP / USD bulls do not leave hopes of storming the resistance at 1.302 and 1.309 and re-activating the Shark pattern with a target of 88.6%. The target is located near 1.34. In my opinion, it makes sense to use the same tactics - to buy the pound in case of a confident breakout of the resistance.

GBP / USD daily chart: